Cast is a personal wealth forecasting and simulation tool built to answer a question that most finance apps avoid: “Where will my money realistically take me?”

Most personal finance tools are backward-looking. They show what you spent, what you earned, and maybe a static net-worth snapshot. Cast is explicitly forward-looking. It models how wealth evolves over time based on assumptions, decisions, and uncertainty — not just historical data.

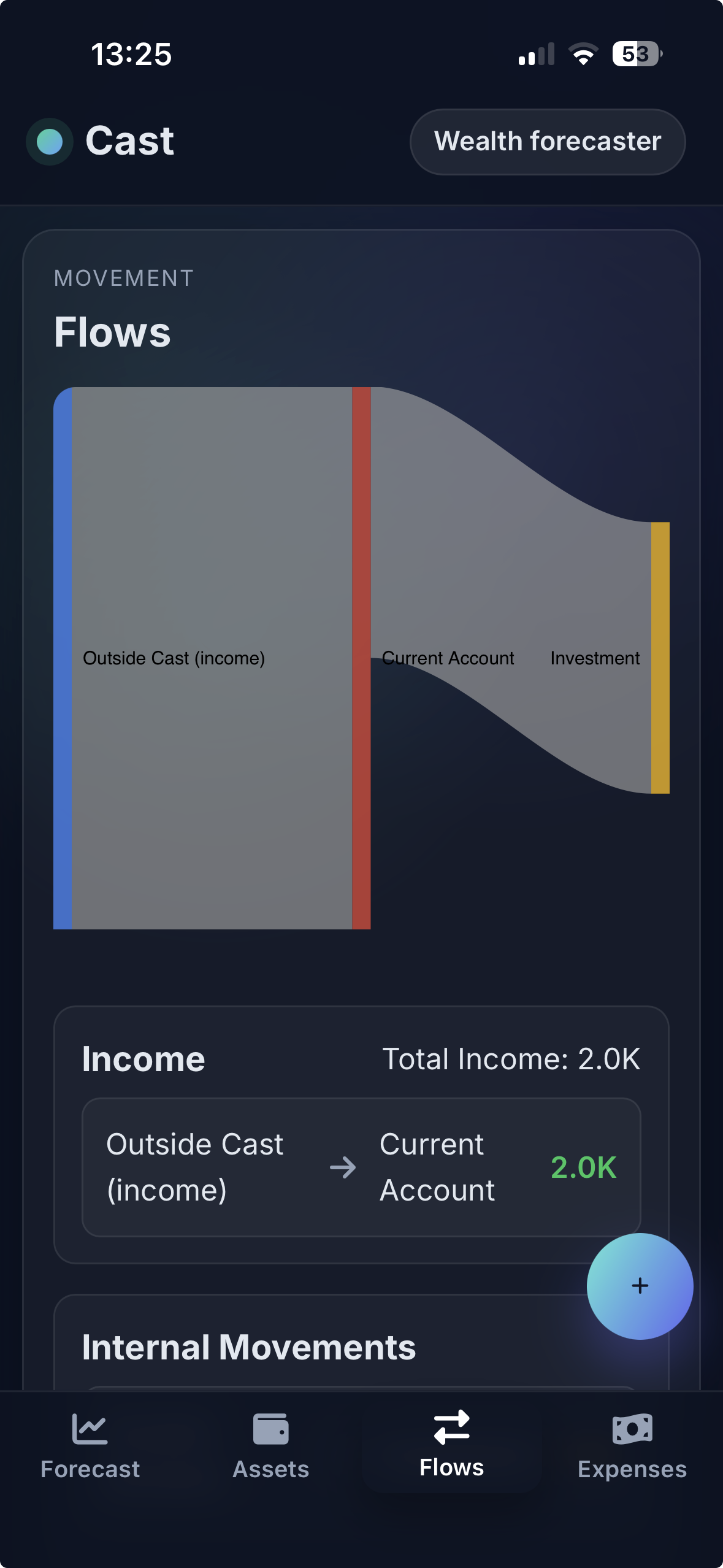

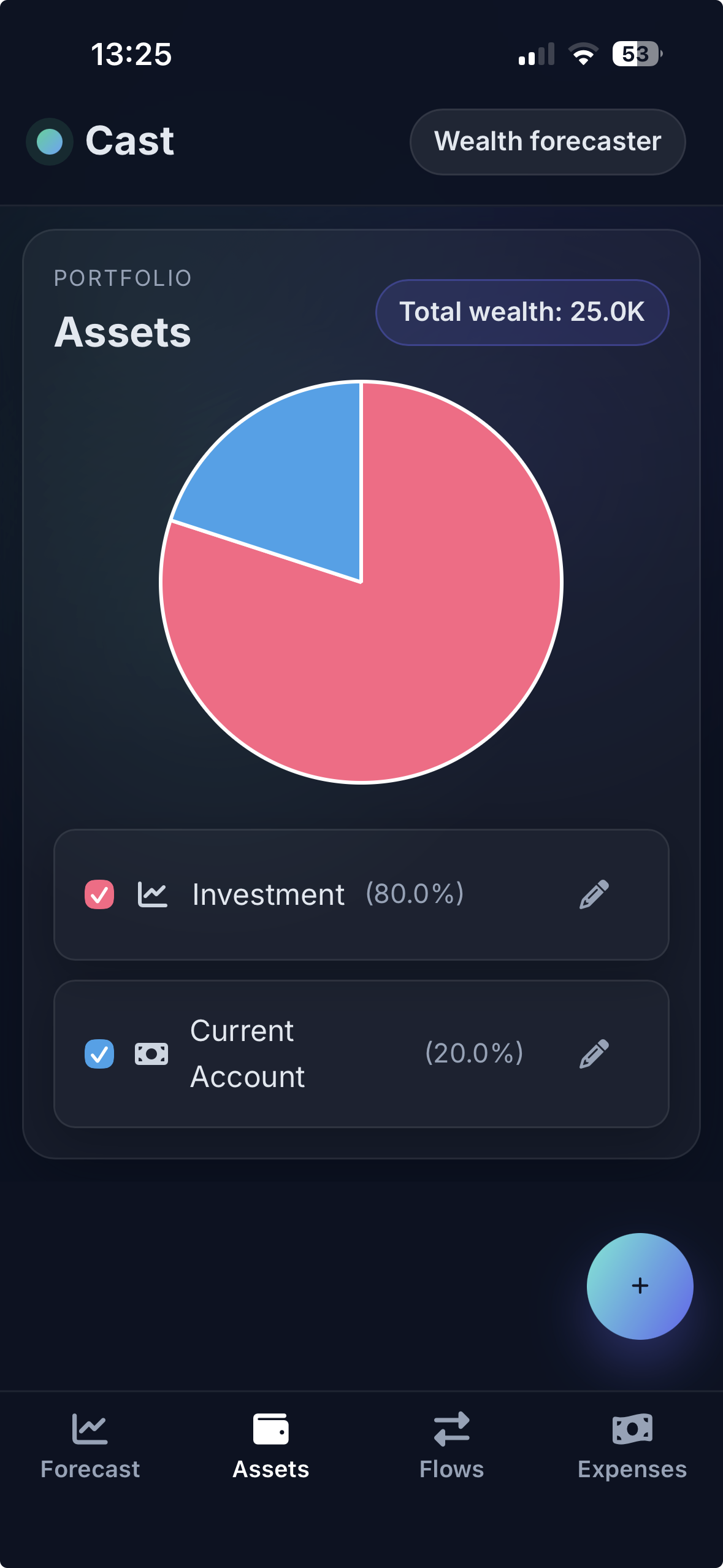

The core idea is simple but powerful: you define your current wealth structure (cash, investments, real estate, liabilities), then simulate how it evolves month by month under configurable rules — expected returns, savings rate, expenses, inflation, major life events, and risk bands.

From a product standpoint, Cast was built to feel analytical but not academic. I wanted something closer to a strategist’s dashboard than a consumer budgeting app. The main visual metaphor is a wealth trajectory: a curve over time showing min / expected / max outcomes, so you immediately see both direction and risk, not just a single deterministic number.

Technically, the app was designed as a lightweight but solid MVP:

- SwiftUI for fast iteration on clean, data-dense UI

- Charts for wealth evolution, composition breakdowns, and scenario comparison

- Firebase as a pragmatic backend for persistence and future extensibility (scenarios, versions, sync)

One deliberate design choice was to avoid over-automation. Cast doesn’t try to “guess” your future. You explicitly control assumptions. This keeps the tool honest: if the forecast looks bad, it’s because the inputs are bad — not because of a black-box algorithm.

From a personal perspective, Cast reflects how I think about money: not as something to optimize obsessively day-to-day, but as a system evolving over decades. Building it forced me to formalize trade-offs I was already reasoning about mentally — stability vs growth, location choices, lifestyle inflation, and the real cost of optionality.

Cast is still an MVP, but it already does its job: it turns vague financial intuition into concrete, visual scenarios. And once you see your future wealth plotted clearly, it becomes much harder to lie to yourself.